Persistent market optimism

Link

A second week of positive correlation between the equity and bond markets on both sides of the Atlantic. Equity markets rallied, with Europe outperforming significantly, while sovereign yields eased, driving bond prices higher. As we are aware, this positive trend was fuelled chiefly by more encouraging inflation figures than expected.

- The pace of inflation slowed mainly due to a downturn in energy and goods prices. The price of goods fell as supply bottlenecks, which had been weighing on production, eased and demand slowed. Investors appear to be reassured by growth resilience, which justifies risk-taking. Anticipation of a recovery in the Chinese economy also boosted the markets. While acknowledging a certain degree of optimism, we nonetheless remain doubtful over the outlook that the market appears to be pricing-in. We believe that disinflation could occur less rapidly, particularly if growth effectively proves to be considerably more resilient. Above all, the central banks are likely to maintain their restrictive policies longer than expected, which is why we are maintaining a moderately more cautious stance. The fourth-quarter 2022 reporting season, which is currently getting underway, should provide further details regarding the financial health of companies and, more importantly, corporate strategies for 2023.

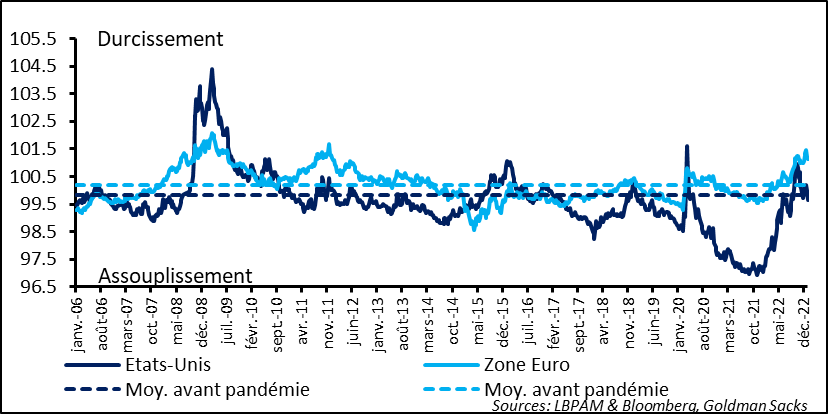

- The strategies adopted by the central banks will remain a key factor in 2023. We still believe that policies will remain relatively restrictive, at least for this year, and relax pressure on demand only gradually. This assumption is based on our view that inflation will fall towards the 2% target more slowly than many observers are anticipating. Restricting financing conditions is the method deployed within monetary policies to curb demand. However, US market trends are currently reflecting easier financing conditions. This is not what the Fed is seeking. In the eurozone, financing conditions remain relatively restrictive, despite easing slightly. The expected pace and extent of base rate hikes remains a key market debate.

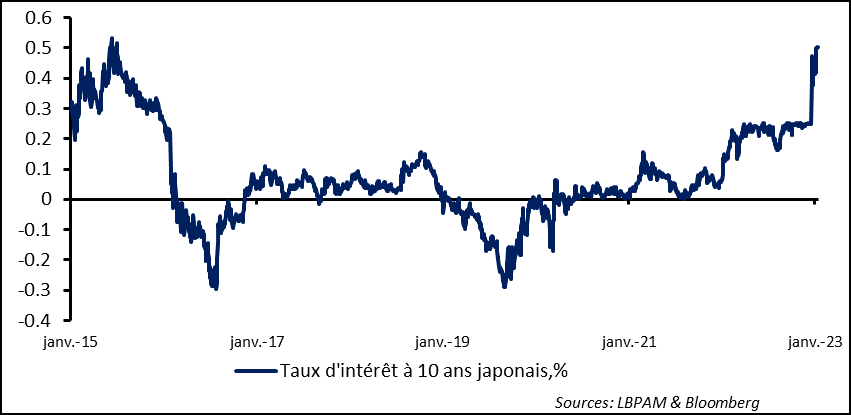

- Japan bucked the global trend over the past year, by adopting a contrarian monetary policy, compared to the other major economies, and maintaining a highly accommodating stance. The central bank (BoJ) governor, Haruhiko Kuroda, set a 0.25% target cap on long-term interest rates, based on 10-year maturities. However, the BoJ surprised the markets at its latest monetary policy meeting, by deciding to increase the target level to 0.5%. This move marginally toughened monetary conditions. Market professionals are eagerly awaiting this week’s meeting. A further surprise towards stricter tightening is expected. We are less convinced however. Nevertheless, consensus is still anticipating a more significant change in April, at the end of the current governor’s tenure.

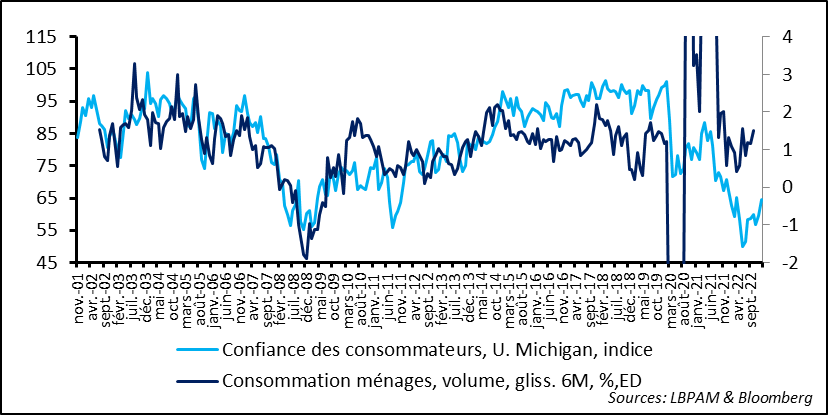

- A strong rebound in American consumption, which has trended higher since the summer, partly accounts for the resilience of business activity in the US. The sharp upward trend has been driven chiefly by persistent strength in the jobs market, with the unemployment rate an historic low of 3.5%. The downturn in inflation, notably energy prices, has also restored American household spending power to a certain extent over the past six months. The further increase in consumer confidence in January, as reflected in the initial findings of the Michigan University survey, corroborates this resilience. Is it sustainable? The jobs market is a late-stage variable within the economic cycle. Can growth be slowed down without affecting employment? This is the other key question determining economic momentum this year. This week, December retail sales data, which is expected to come in lower, will provide a clearer view on whether consumer spending is holding up or not.

Central banks generally tend to toughen financing conditions in order to slow down the economy. Discussions reported in the minutes of the Fed December monetary policy meeting revealed that members were concerned that financing conditions were easing, whereas the Fed had adopted a more hawkish stance. The reasons underlying the easing of financing conditions are clear, i.e. the market does not believe central banks’ forward guidance statements.

The situation has not changed. The idea that the Fed’s base rates may reach or even exceed 5%, as indicated by key members of the Fed, is not the current assumption priced into the market. More specifically, the market believes that there will be significant rate cuts at the end of the year. The latest inflation data has supported these market assumptions, along with comments from certain monetary policy committee members, who have called for more moderation in the rate-hike cycle.

Financing conditions have eased overall, falling below the average level observed over the past 20 years. The situation in the eurozone is slightly different however, where financing conditions have eased recently but nonetheless remain restrictive.

Fig.1 Financing conditions: easing in the US but remaining restrictive in the eurozone

What strategy will the Fed adopt? Will it follow the market trend based on the assumption that inflation will fall rapidly and that tightening will soon come to an end? Jerome Powell tends to avoid clashing with the market. However, he must simultaneously ensure that monetary policy succeeds in curbing inflationary pressures. A base rate hike of either 25 or 50bps at the February meeting will be a clear sign of the Fed’s choice.

The BoJ maintained its accommodating policy over the past year, in contrast with most other major central banks. The governor, Haruhiko Kuroda, surprised the markets at the latest monetary policy meeting by raising the ceiling limit on 10-year rates from 0.25% to 0.50%, i.e. tightening rates slightly.

Fig. 2 Japan: Kuroda surprises the markets by revising the ceiling level on 10-year rates.

Although a change in monetary policy was expected, it was presumed to be after the end of the governor’s tenure in April of this year. Initial changes towards a more restrictive policy or a different strategy could therefore occur at an earlier date.

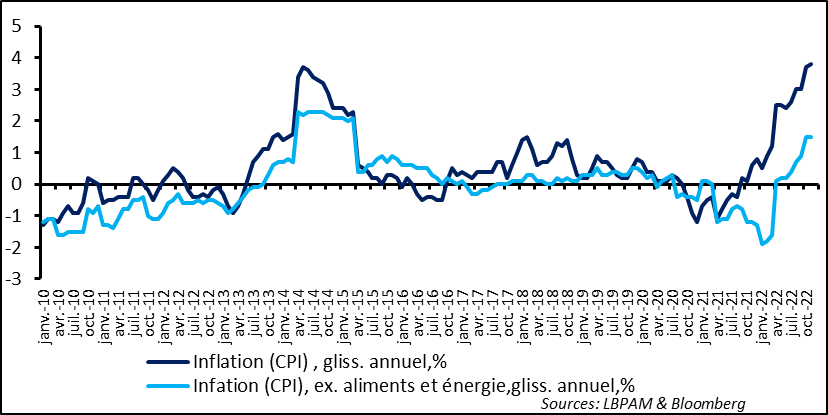

The market is therefore eagerly awaiting the decisions which will be taken on Wednesday. Any significant tightening of monetary policy can certainly be excluded however. Kuroda has effectively continued emphasising that although headline inflation is at an all-time high, core inflation still remains below the BoJ target level.

Fig. 3 Japan: headline inflation at highs, but core inflation has not yet reached the BoJ target

In these conditions, the central bank is obliged to maintain an accommodating policy. However, maintaining the 10-year rate target may have reached its limits, with the BoJ’s balance sheet now far exceeding 100% of GDP.

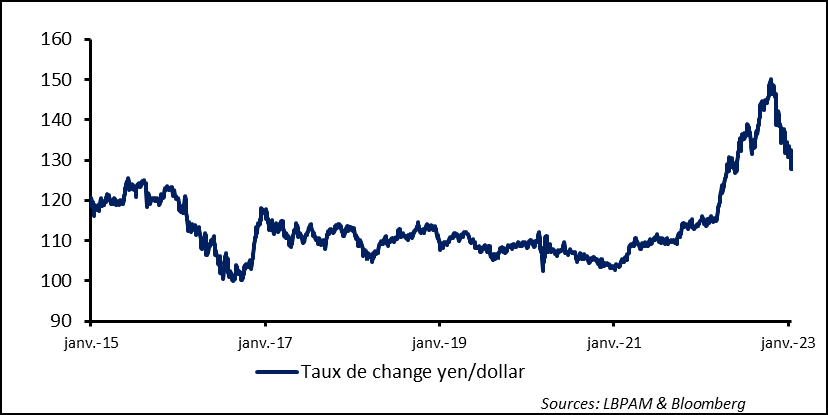

The changes already implemented have helped drive the yen higher against the dollar. However, the rally has also been due to the dollar’s weakness against all other currencies, with the market expecting the Fed to adopt a less stringent monetary policy over the next few months. The rise in the yen will nonetheless reduce exterior inflationary pressures and will not necessarily please the monetary authorities.

Fig. 4 Japan: dollar weakness and yen strength, driven also by rising Japanese rates

Consumers remain one of the key drivers in the US economy in 2023. Consumption during the second half of 2022 may be surprisingly strong. However, the buoyant jobs market, with the unemployment rate at an all-time low, is the main reason for the strength in consumer spending. Similarly, lower inflation, chiefly due to the downturn in energy prices, has also boosted household spending power.

The latest Michigan University consumer survey clearly demonstrates that confidence remains on a recovering upward trend, although still at low levels. This factor may continue providing support for consumption.

Fig. 5 US: consumer confidence (Michigan University), increasing since summer 2022

However, the employment rate must remain as strong as it is today for this to be the case. Employment is a late variable in the economic cycle. We are still expecting a further downturn in business activity, which should become apparent in the jobs data towards the end of this quarter.

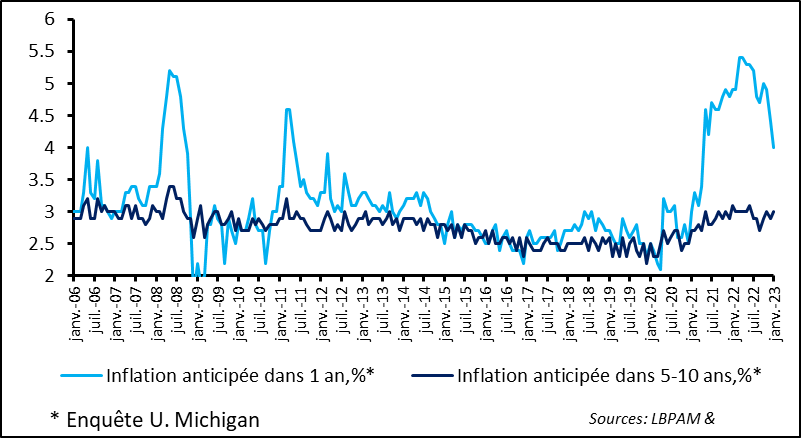

Trends in inflation, which have been relatively favourable over the past few months, may therefore contribute towards supporting consumption. Short-term inflation outlook (1 year) has thus fallen sharply, but remains high. If inflation outlook continues to decline, it will underpin consumption and will also help the Fed in its decision-making.

Fig. 6 US : decelerating inflation, notably due to energy, has contributed towards lower consumer inflation outlook.

Sebastian Paris Horvitz