Disinflation is well underway, validating the end of the cycle of key rate hikes

Link

- After a complicated third quarter on the markets, marked by the first decline in equity and bond markets since Q3 2022, the fourth quarter begins with slightly more positive news.

- A last-minute budget agreement was reached this weekend in the United States, allowing the government to be funded until November 17. However, this agreement does not include funding for Ukraine, and the risk of a budget shock in mid-November remains high given the growing tensions between Republicans in the House.

- Industrial business confidence in Asia improved slightly in September, suggesting that the worst of the global industrial cycle is behind us, even if the recovery is not straightforward. Japan's Tankan indicator shows that Japanese companies remain confident that the domestic economy will rebound in the 2nd half of the year, and that large manufacturers are more optimistic. In China, September's PMIs were mixed, with a rise in official PMIs and a fall in S&P global PMIs for both industry and services. In our view, this suggests that the Chinese economy is stabilizing thanks to the public sector, but that private-sector confidence remains depressed. This suggests that Chinese growth will stabilize but not rebound in the coming months.

- Above all, the good news is the greater-than-expected fall in inflation in the Eurozone in September and in the United States in August. Total and underlying inflation fell well below 5% in the Eurozone, thanks to less unfavourable technical effects, but also to the beginning of a slowdown in domestic tensions. In the United States, the Fed's preferred measure of inflation fell below 4%, thanks in particular to a slowdown in the price of services excluding housing.

- Inflation remains more than twice above central bank targets on both sides of the Atlantic, and convergence towards this target is likely to be long and uncertain. So we shouldn't be too quick to declare victory, a message that central banks are likely to keep to until the end of the year. But the fact that core inflation is beginning to slow more markedly supports our view that the Fed and ECB are done with rate hikes and may even start to cut rates a little from next spring.

- Monetary policy and, above all, the market's review of rate expectations could therefore be less of a brake on the markets from now on, and even provide some support as we approach the end of the year. On the other hand, we still believe that market expectations of growth and profits are too high. Admittedly, certain shocks have been avoided at the start of Q4, and seasonality is more favourable to risky assets, but the risk of an economic slowdown, particularly in the US, is underestimated in our view. Against this backdrop, we are overweight fixed-income products and remain slightly underweight the riskiest assets, in particular equities and high-yield credit.

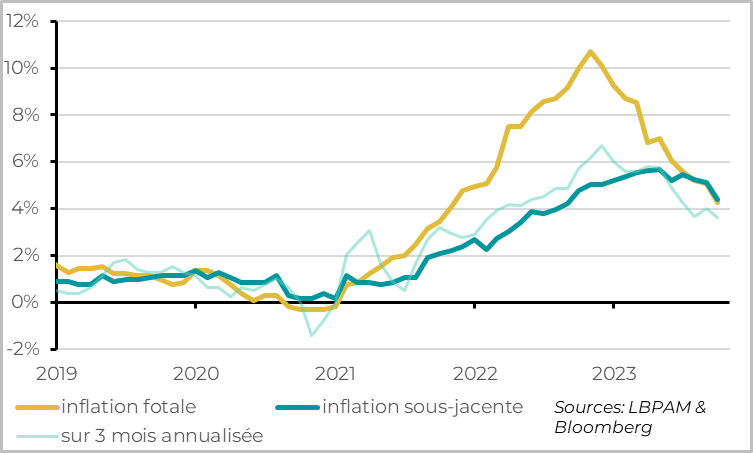

Fig.1 Eurozone: inflation back below 5% in September, especially core inflation

Eurozone inflation slowed in September from 5.2% to 4.3%, its lowest level since the start of the Ukraine invasion.

While energy and food inflation were down, the real surprise was the sharp slowdown in core inflation, from 5.3% to 4.5% in September. A slowdown to below 5% had been expected due to the end of technical distortions which had artificially increased core inflation this summer (train fares in Germany, the change in points for hotels and restaurants...). But core inflation has fallen more than expected, and even stagnated in September if we adjust for seasonal variations.

This suggests that the slowdown in inflation is more widespread and faster than expected. That said, core inflation is still more than 2 times above the ECB's target, and we'll have to wait for the publication of detailed inflation figures in October to see whether this slowdown extends to domestic services (which was not the case until August).

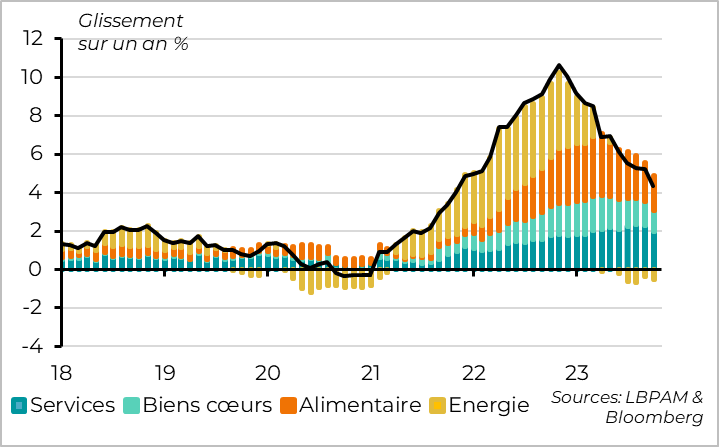

Fig.2 Eurozone: slowing inflation extends to services for the first time since 2021

Energy prices rose in September due to higher oil prices. However, year-on-year they are falling (-4.6% after -3.3% in August), as gas and electricity prices were extremely high in Q4 2022. Energy inflation should fall further in October-November due to base effects, before starting to normalize from December onwards.

Food inflation continues to slow rapidly, from 9.7% to 8.8%. It should continue to slow sharply over the coming months, while remaining historically high.

Industrial goods prices fell for the first time since 2021 in September, allowing core inflation to slow more sharply, from 4.7% to 4.2%. Given the weakness of goods demand in Europe and the global industrial cycle, goods price inflation should converge below 2% by early 2024.

While the fall in goods prices is broadly in line with expectations, the good news comes from inflation in services, which is finally slowing sharply, from 5.5% to 4.7% in September. Much of this decline is probably due to technical factors, and is reinforced by volatile components (transport, tourism...). But the fact that the slowdown was much sharper than expected in September gives us hope that prices for services linked to domestic conditions are finally beginning to slow for the first time since inflation accelerated two years ago.

Even after September's figures, we believe it will take time for domestic prices to return to levels compatible with the ECB's target. But at least a faster-than-expected slowdown in inflation, coupled with signs of weakness in activity, strengthens the chances that the ECB will not raise rates further in the coming months.

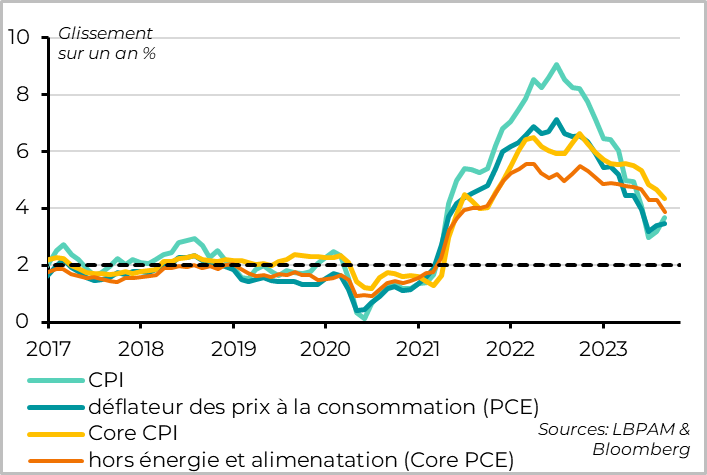

Fig.3 United States: Fed-tracked inflation falls below 4% in August

Inflation is also slowing sharply in the United States. The Fed's preferred measure, the consumer price deflator excluding energy and food, fell below 4% in August. At 3.9%, it remains almost twice the Fed's target, but at its lowest for over 2 years. Above all, the Fed should be reassured by the fact that underlying inflation is slowing (1) even more sharply on a sequential basis (August's price rise was the weakest since 2020), (2) across the board, and (3) particularly in services excluding housing. That said, inflation is still twice above target, which should prompt the Fed to remain cautious in the short term.

On the other hand, the total consumer price deflator rebounded slightly for the second month running, to 3.5%, on the back of higher energy prices. This rise is likely to continue in September, given the sharp rise in oil prices last month. This is not the most important issue for the Fed, but it does have a negative impact on household purchasing power. While household incomes rose by 0.4% in August, after 0.2% in July, they remain stagnant after inflation is taken into account.

Consequently, the relative resilience of consumption (+0.1% in August after +0.6% in July) is financed by a fall in the savings rate. Although the latter has been revised upwards, it is well below its pre-Covid level of 3.9%. With accumulated savings running out and student loan repayments resuming, we believe that US households will find it hard to consume as much as they did this summer as the year draws to a close.

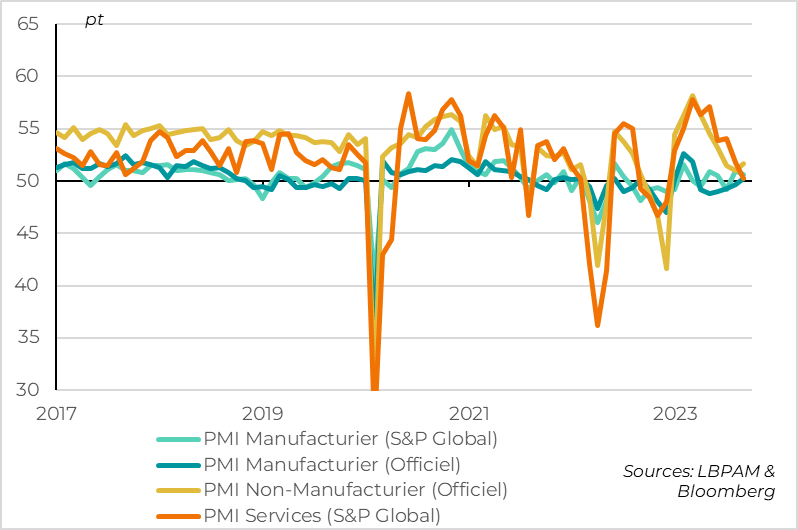

Fig.4 China: PMIs suggest fragile stabilization of growth in September

China's official PMIs rose slightly in September. The manufacturing PMI rose above 50pt for the first time in 6 months (50.2pt), while the non-manufacturing PMI reached a 3-month high (51.7pt). Both remain well below their historical averages, but have been progressing for the past two months in a zone of slight expansion.

On the contrary, S&P Global's private PMIs fall sharply again in September, so that the composite PMI is at its lowest since the end of the Zero-Covid policy at the end of 2022. The manufacturing PMI reversed part of its August rebound (to 50.6pt) and, above all, the services PMI fell by 1.6pt close to the stagnation zone (50.2pt).

The slight rebound in official PMIs, which cover a large number of companies including major public corporations, is reassuring and suggests a stabilization of the economy thanks to the support of the authorities. But the weakness of private PMIs, more focused on small private companies, suggests that this stabilization is unbalanced and fragile, and that confidence in the private sector remains low.

All in all, this is in line with our scenario, which forecasts a stabilization of the Chinese economy by the end of 2023, which would enable the authorities to achieve their 5% growth target for this year, but without any real rebound, leaving the Chinese economy on a path of marked trend slowdown in medium-term growth prospects.

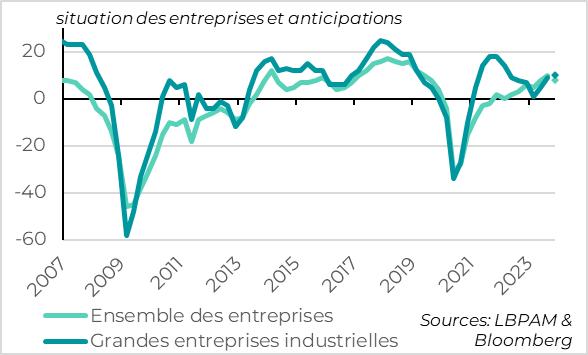

Fig.5 Japan: Japanese industrial confidence rebounds in Q3

The Tankan survey of Japanese companies for Q3 shows that the recovery continues in Japan. Business confidence rose by 8 to 10pt, its highest level since the start of the Covid, and should remain stable in Q4.

Above all, while the confidence of companies exposed to the domestic economy (SMEs, service companies) remains very solid, the confidence of large industrial companies more exposed to the global cycle rebounds more than expected for the 2nd consecutive quarter (to 9pt). This suggests a stabilization of the global industrial cycle, which has so far been very depressed.

Finally, with regard to the inflation outlook, companies are indicating that pressures on capacity and employment are continuing to increase, and they expect their selling prices to continue to rise fairly rapidly over the medium term. This is good news for the Bank of Japan, which may be more confident that its long-term inflation target of 2% is in sight.

Although the exit from the BoJ's ultra-accommodative policy will be gradual, it could accelerate from the end of 2023. This supports Japanese 10-year yields, which, at 0.77%, are at their highest level in 10 years. It is also contributing to the rise in long rates in the United States and Europe.